Strategy Analytics: Global Smart Speaker Shipments Declined 5% in 1Q22 Amid Disruption from War and a Resurgent COVID Virus

New disruptions to the global component shortage caused by Russia's war against Ukraine and a resurgence of COVID-19 in greater China have disrupted the smart speaker and smart display markets.

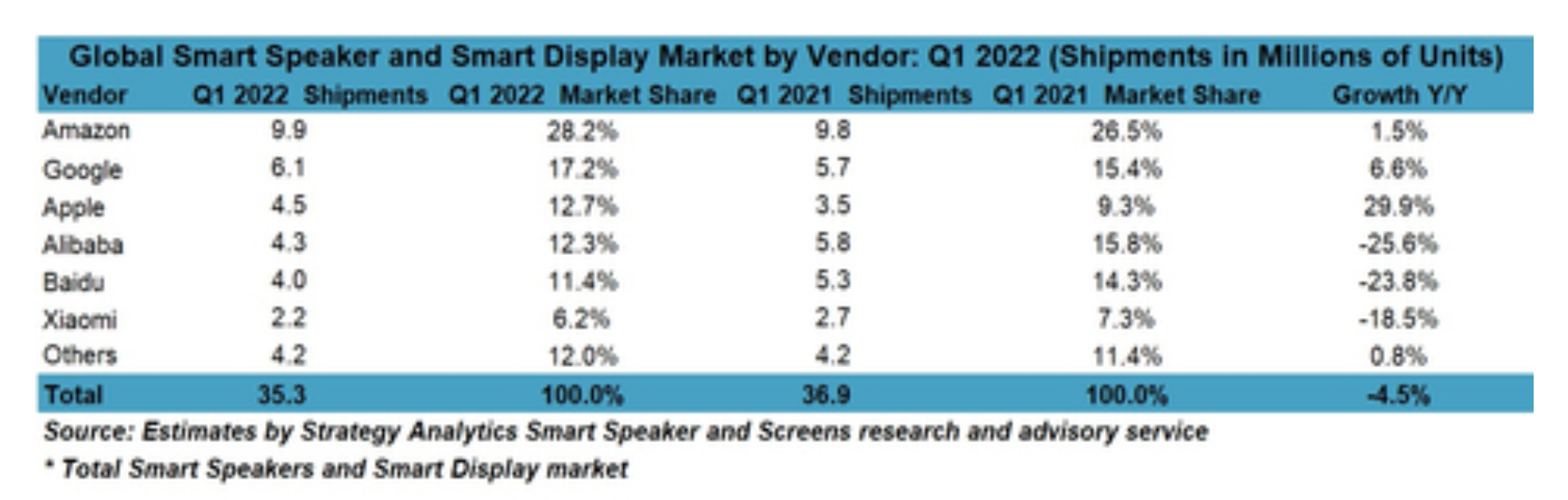

Strategy Analytics estimates total smart speaker and smart display shipments declined 5% year-over-year to 35.3 million units, only the second year-over-year decline in the market’s history.

Sales of Smart Displays in Q1 2022 fell 7% year-over-year 9.9 million units, as smart display-heavy vendors Alibaba, Baidu, and Xiaomi are only beginning to deal with a set of challenges unique to them that will completely alter the trajectories of their respective smart speaker and smart display businesses through 2023.

New disruptions to the global component shortage caused by Russia's war against Ukraine and a resurgence of COVID-19 in greater China have disrupted the smart speaker and smart display markets, according to the latest research from Strategy Analytics’ Smart Speakers and Screens service. Strategy Analytics estimates total smart speaker and smart display shipments declined 5% year-over-year to 35.3 million units, only the second year-over-year decline in the market’s history.

Jack Narcotta, Strategy Analytics

Russia's war against Ukraine, and the ongoing and intensifying shortage of semiconductors and other components became crippling concerns for many vendors especially the smart display-heavy trio of Chinese companies Alibaba, Baidu, and Xiaomi, which also continued to deal with unprecedented resurgences of COVID-19 that shut down daily life for many Chinese. Sales of Smart Displays in Q1 2022 fell 7% year-over-year 9.9 million units, as smart display-heavy vendors Alibaba, Baidu, and Xiaomi are only beginning to deal with a set of challenges unique to them that will completely alter the trajectories of their respective smart speaker and smart display businesses through 2023. Sales of basic smart speakers (without a display) declined about 4% over the same period as the US market begins to show signs of smart speaker market saturation. Nineteen of the top 50 models sold in Q1 2022 were smart displays, with the second generation of Amazon’s Echo Show 5 taking the smart display crown in Q1 2022 with 1.6 million units shipped, followed by Google’s Nest Hub and then the second generation of Amazon’s Echo Show 8. Apple’s HomePod Mini was the top-selling device overall in Q1 2022, at just under 4.5 million units, followed by Amazon’s fourth-generation Echo Dot and then Google’s Nest Mini.

In the overall smart speaker and smart display market in Q1 2022, the top two spots remained unchanged, with Amazon at No. 1 followed by Google. Apple jumped into the No. 3 spot largely due to the trio of Chinese companies being severely hampered by large portions of China’s economy and society coming to halts as cities were locked down to contain COVID. While year-over-year growth for Apple's HomePod mini remains statistically impressive, Strategy Analytics expects Apple’s growth to slow significantly in 2023 as Apple exhausts opportunities to sell HomePods to its iPhone customer base.

Global Smart Speaker and Smart Display Market by Vendor: Q1 2022 (Shipments in Million of Units), Source: Estimates by Strategy Analytics' Smart Speaker and Screens service

“Strategy Analytics forecasts a market reset into calendar 2023 as two market dynamics emerge,” noted Jack Narcotta, Principal Industry Analyst, Smart Home, Smart Speakers, and Smart Displays. “First, in the US market, smart speaker and smart display penetration rates are approaching a state of market saturation, and the market is shifting from new customer acquisition to add-on or replacement sales which historically have longer sales cycles. Second, in China, slowing the surge in COVID-19 will take time, and compounded with the ongoing component shortage, economic recovery will be hampered until at least mid-2023.”

David Watkins, Director, Intelligent Home added, “There is no question that Alibaba, Baidu, and Xiaomi have their work cut out for them over the next 18 to 24 months, though they do have the benefit that China’s smart speaker and smart display markets are not as saturated as the US. In the US, Amazon and Google are rapidly entering their ‘adult’ years, as most consumers that desired an Echo or Nest device have likely purchased at least one of the devices. Amazon and Google’s primary tasks in 2022 and beyond will be to adjust their business to upselling additional devices to consumers or encouraging them to update older models.”

To read more, please visit: https://www.strategyanalytics.com