India’s PC Market Hits Record High 4.9 Million Units Shipped in Q3 2025, Driven by AI and Festive Demand – IDC –December 29, 2025

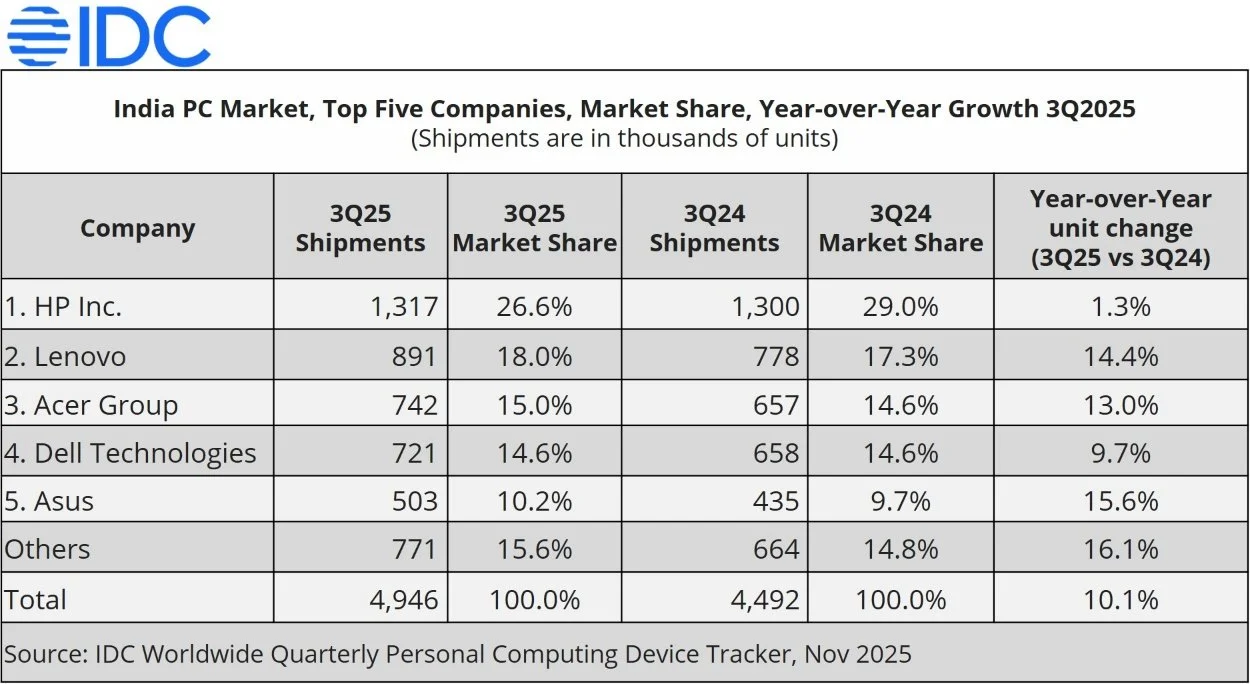

India’s traditional PC market—including desktops, notebooks, and workstations—recorded a strong 10.1% year-over-year (YoY) growth in Q3 2025, with shipments reaching 4.9 million units. This marks the market’s highest-ever quarterly performance, surpassing the previous record of 4.5 million units shipped in Q3 2024, according to data from the International Data Corporation (IDC) Worldwide Quarterly Personal Computing Device Tracker.

Strong Growth Across All PC Categories in Q3 2025

All three PC categories witnessed strong YoY growth in Q3 2025:

Notebooks, the largest segment, grew 9.5% YoY.

Desktops registered a solid 11.6% YoY increase.

Workstations led with the highest growth at 14.2% YoY.

The premium notebook category (priced above US$1,000) rose 8.5% YoY, fuelled by sustained demand for high-performance devices across both consumer and enterprise segments.

AI-enabled notebooks maintained their sharp growth trajectory, with shipments soaring 126.5% YoY. Basic AI notebooks—powered by hardware-based AI features—accounted for 85.9% of total AI notebook shipments, supported by aggressive discounts and cashback offers. Meanwhile, next-generation AI notebooks are rapidly gaining momentum, surpassing the 100,000-unit shipment mark for the first time in a single quarter.

Commercial Segment Fuels Growth as Consumer Demand Skyrockets

The market saw balanced momentum across both commercial and consumer segments in Q3 2025. The commercial segment grew 11.4% YoY, driven by ongoing enterprise refresh cycles and robust demand from small and medium businesses (SMBs), which grew 18.8% and 13.1% YoY, respectively.

The consumer segment reached new heights, with vendors front-loading shipments ahead of the early festive season. Consumer PC shipments hit a record 2.8 million units, marking the segment’s highest-ever quarterly performance. Notebooks dominated in the e-tail channel, which achieved its best quarter yet with 997,000 units shipped.

“PC shipments surged in the consumer segment as demand strengthened across all channels,” said Bharath Shenoy, research manager, IDC India & South Asia. “Consumer buying patterns have shifted, with many postponing purchases after the back-to-school season to capitalize on deep discounts during e-tail festivals. This trend prompted vendors to scale back Q2 shipments and build up inventory for Q3’s major sales events, which unfolded in three waves from late September to early November. To maintain parity, several vendors also aligned offline pricing with online offers.”

HP Inc. led India’s overall PC market in Q3 2025 with a 26.6% share, securing the top position in both the consumer and commercial segments. The company dominated the commercial segment with a 34.6% share, supported by strong enterprise and SMB demand. However, its consumer segment declined 10.4% YoY, impacted by intense competition across both premium and entry-level price bands. Additionally, HP’s transition from the Pavilion series to the new OmniBook lineup is taking time to gain the desired traction in the market.

Lenovo retained the second position in India’s overall PC market in Q3 2025 with an 18% share. The company’s consumer segment grew 14.3% YoY, supported by aggressive offers, discounts, and cashback promotions during festive e-tail sales. Its commercial segment also expanded 14.5% YoY, driven by strong momentum in the small office (SO) segment, where Lenovo led the market with an impressive 46.9% YoY growth.

Navkendar Singh, associate vice president, Devices Research, IDC

Acer Group ranked third in India’s overall PC market in Q3 2025 with a 15% share. In the consumer segment, growth was fueled by an aggressive e-tail push, particularly for entry-level notebooks. The company’s commercial segment also expanded 4.1% YoY, as Acer led the commercial desktop category with a 33.1% share, supported by strong demand from government and enterprise orders.

Dell Technologies ranked fourth in India’s overall PC market in Q3 2025 with a 14.6% share. After a few challenging quarters, Dell performed better in the consumer segment, capturing a 10.3% share, supported by strong channel push and leaner starting inventory. The company also delivered steady growth in the commercial segment, recording a 6.9% YoY increase driven by healthy enterprise demand.

Asus held the fifth position in India’s overall PC market in Q3 2025 with a 10.2% share. With a balanced presence across offline and online channels, Asus ranked second in the consumer segment with a 15.9% share, trailing only HP. The company also recorded its best-ever commercial quarter, shipping over 64,000 units, primarily driven by strong demand from the SMB segment.

Outlook for PC Market Remains Positive Amid Enterprise Demand and Government Initiatives. Commenting on the market outlook, Navkendar Singh, associate vice president, Devices Research, IDC India, South Asia & ANZ, said: “Despite a series of strong quarters, Windows refresh orders are expected to remain healthy over the coming quarters, as several pending deployments are yet to be completed. However, aggressive channel push could lead to inventory corrections within the SMB segment, while processor supply constraints may cause minor shipment delays. On the consumer side, short-term adjustments are likely due to elevated channel inventory, but overall demand for consumer notebooks remains resilient and is expected to stay strong through the first half of 2026.”

To learn more, visit: www.idc.com