Fixed Wireless Access Forecast 2025-2030 – IDC – January 9, 2025.

RAN Research has published its latest market forecast, providing an update on the FWA market. Mapping new countries in Europe (Belgium, France, Germany, and Spain), the forecast explores the next five years for FWA, as it eventually comes into contact with 6G. The report’s free executive summary can be downloaded here.

The narrative surrounding FWA, that it has been the sole 5G-based bright spot for MNOs, remains unchanged. Operators have been let down by the marketers and evangelists over-hyping the 5G opportunity.

With FWA, they have at least managed to break into previously entrenched fixed-line broadband markets.

The report shows that total global FWA connections (including the cellular-based hybrid approaches used by operators to augment aging copper broadband lines) are projected to grow from 147 million to 270 million between 2025 and 2030, with the annual service revenue growing from around $38.65 billion to $66.44 billion through the period.

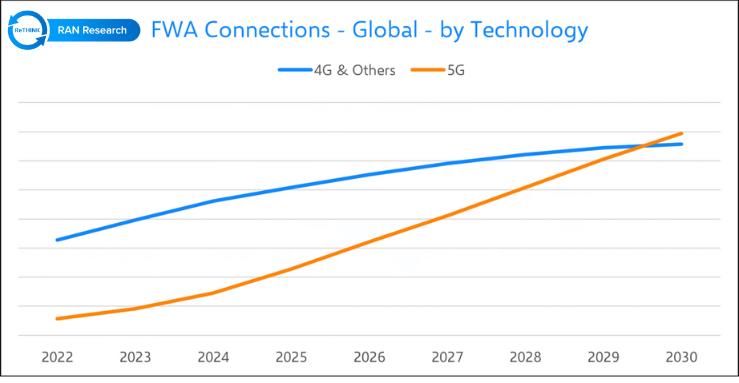

Notably, the roadmap for FWA shows that 5G connections will pass the 4G & Others segment in 2029. RAN Research notes that the 4G & Others total is still growing at the end of the period – but looks set to finally decline in 2031.

This brings it into the start of the 6G cycle, which is expected to begin in 2030. The report notes that this might distract MNOs in this window, as attention turns from mature FWA markets into the hope for new revenues enabled by 6G – although MNOs that have had their fingers burned by 5G claims will tread very carefully this time.

Consumer connections still dominate the FWA market, but the amount of business connections does grow through the period, notes RAN Research.

Per the report’s introduction, “there are distinct regional differences at play, at every level of the FWA stack – spanning spectrum to CPE. With Nokia putting its FWA CPE business into the evaluation division, signaling a divestment, there is some level of vendor disruption on the cards that must be considered.

FWA has progressed significantly in the past few years. It has enjoyed a wave of success in the somewhat unique circumstances of the US broadband market, where FWA has addressed poor fixed-line competition from entrenched cable providers and patchy telco coverage – proving that the US was far from broadband saturation.”

The difference between ARPUs globally remains a challenge, with less valuable markets having to tread carefully on the cost of CPE and customer support. At the upper end, monthly ARPU reaches around $60. At the lower end, it remains under $2.

Because of this imbalance, APAC is the largest market by number of connections, but is the fourth largest when revenue is measured. Europe is close to half the number of FWA connections as APAC, but is nearly 4x larger in revenue terms.

The report notes that “FWA is still minor compared to global mobile connections, but relative to fixed-line broadband, it represents a significant share by the end of the forecast period.

For many MNOs, FWA can enhance 5G densification strategies – though careful traffic analysis will be essential to avoid congestion.”

There are something like 1.5 billion fixed-line broadband connections globally, and so RAN Research’s count of 270 million implies a penetration rate of 18% – up from around 10% today.

FWA’s success in APAC is often found in areas with no existing fixed-line infrastructure – that is, completely greenfield opportunities for MNOs to leverage their cellular networks. In more advanced fixed-line markets, there are still plenty of hard-to-reach properties that have been poorly served by fixed-line services, which are leaping at the opportunity to use FWA. LEO-based satellite services are also a factor to consider, but are outside the scope of this forecast.

RAN Research notes that “in summary, FWA is still minor compared to global mobile connections, but relative to fixed-line broadband, it represents a significant share by the end of the forecast period.

For many MNOs, FWA can enhance 5G densification strategies – though careful traffic analysis will be essential to avoid congestion.”

Cell density will be an ongoing concern for MNOs. Our exploration of T-Mobile’s million-person waitlist from January this year explores this dynamic – where adding an FWA user to a cell can negatively impact the mobile users, due to the relatively high usage of the FWA connection, compared to smartphones.

FWA will also benefit from government support, per RAN Research. “Governments around the world are increasingly intent on narrowing digital divides.

Many have introduced incentives aimed at ‘leveling up’ rural connectivity, and FWA is gaining traction as a key component of the broadband mix for underserved communities – as FTTH saturation gets nearer each day.”

The forecast charts the number of connections (both 5G and the 4G & Other segment), the ratio of consumer to business connections, and the service revenue for FWA (including the ARPU). Through 78 pages and 72 graphs, RAN Research lays out the state and future of FWA.

We break down:

5G and 4G/Others - connection growth

Consumer and Business - adoption potential

Revenue outlook

CAGR

ARPU

All split by region and key countries