Worldwide External Enterprise Storage Systems Market Revenue Increased 2.1% During the Third Quarter of 2025 – IDC – January 2, 2025.

According to the International Data Corporation (IDC) Worldwide Quarterly Enterprise Storage Systems Tracker, the external OEM enterprise storage systems (ESS) market grew 2.1% year-over-year (YoY) in the third quarter of 2025 reaching $8.0 billion in vendor revenue. From the historical perspective, this level of growth is solid for the mature ESS market but still is eclipsed by the high double-digit growth in the server market, which is driven by investments in accelerated server infrastructure.

Revenue associated with All Flash Arrays showed more dynamic by growing 17.6% YoY while Hybrid Flash Arrays and Hard Disk Drives Arrays declined 9.8% and 6.3% respectively. “The penetration of AI-infused applications and AI models into corporate datacenter will increase the need for more dedicated and efficient enterprise storage systems. IDC expects growing demand for flash storage to support projects related to artificial intelligence, both for training and inferencing,” said Juan Seminara, research director, Worldwide Enterprise Infrastructure Trackers.

Juan Seminara

When slicing the market by price bands groups, the fastest growing portion was Midrange (systems with average selling price from 25$K to 250$K) that showed 8.1% growth in the quarter that already represents 67.5% of the total external storage market, while High End (systems more than 250$K) declined 9.0% and Entry (systems less than $25K) decrease by 8.0%.

External Storage Regional Market Results

Regional view shows disparate performance with double digit growth in Japan, Canada and EMEA that grew 14.4%, 12.6% and 10.5% respectively- PRC and APeJC showed single digit growth of 9.5% and 8.6% while Latin America barely decrease by 0.9%. The negative note of the quarter was USA performance that showed a 9.9% decrease compared to the same quarter of 2024 after a weak performance in the OEM market.

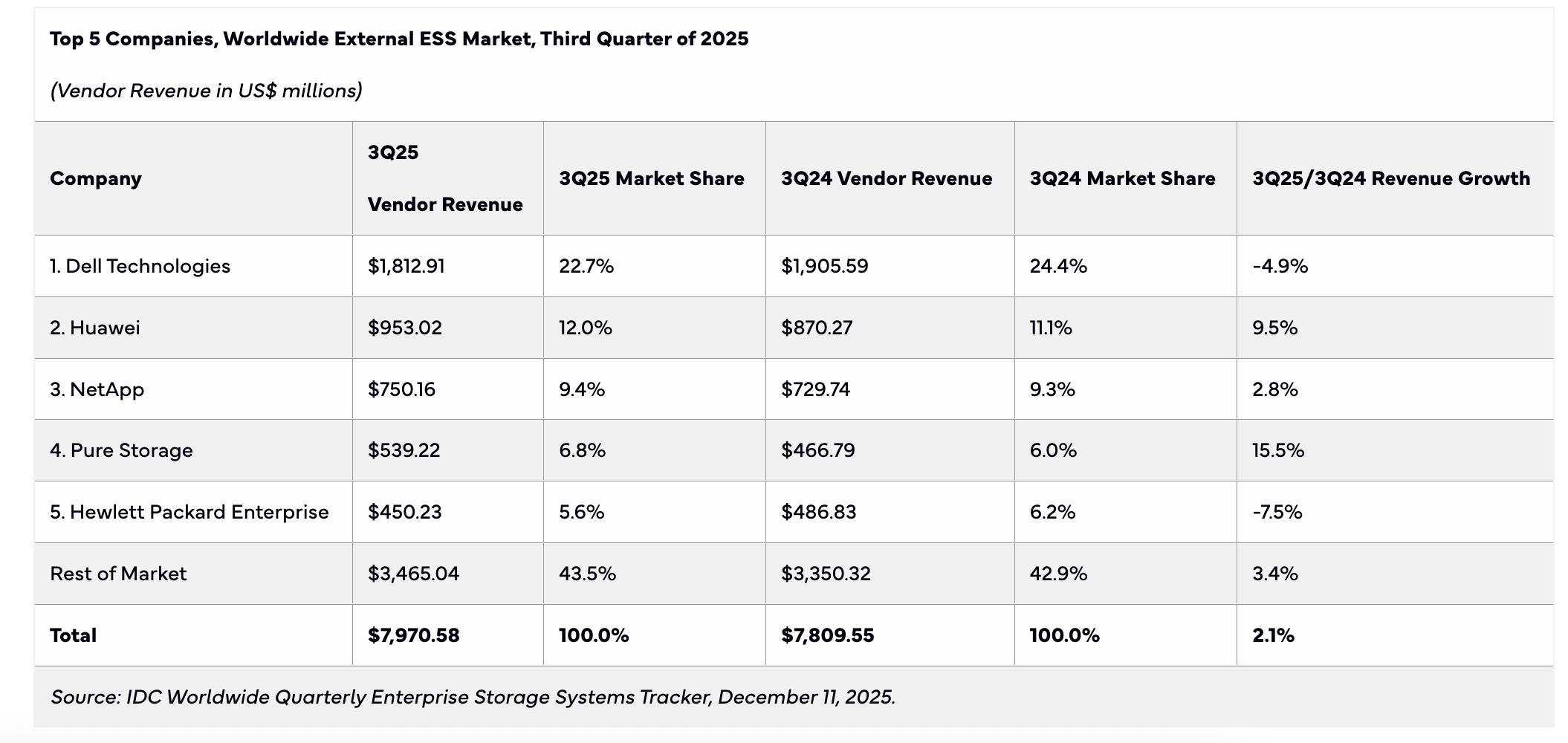

Overall External Storage Market Standings, by Company

Despite a single digit decline, Dell Technologies led the External ESS market with 22.7% revenue share while is focusing more on core products, Huawei reached second place with 12.0% revenue share fueled by a very strong performance in PRC market. NetApp finished third with 9.4% share thanks to a solid performance in AFA. Pure storage reached fourth place with 6.8% share due to a double-digit growth in the quarter. Finally, Hewlett Packard Enterprise was fifth with a 5.6% market share.

IDC's Worldwide Quarterly Enterprise Storage Systems Tracker greatly enhances clients' ability to effectively respond to today's dynamic storage market. Understanding which global markets and segments are growing and knowing the quarterly adoption curve for new products have become business-critical needs for enterprise storage vendors, supply chain partners, and the financial community. This product provides insight into customer trends by delivering geography-specific vendor and product-line details across all storage segments. This Tracker is part of the Worldwide Quarterly Enterprise Infrastructure Tracker, which provides a holistic total addressable market view of the four key enabling infrastructure technologies for the datacenter (servers, external enterprise storage systems, and purpose-built appliances: HCI and PBBA).

To learn more, visit: www.idc.com